Job Openings Slide To Three Year Low As Hiring Suddenly Craters Below Pre-Covid Levels, Quits Tumble

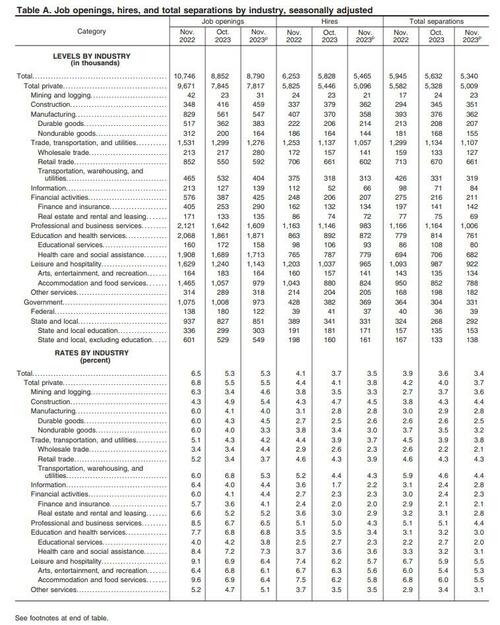

After several months of sharp moves in both directions, the most recent of which was the unexpected 617K plunge in the number of US job openings to 8.733 million, the lowest since March 2021, moments ago the BLS reported the latest, November JOLTS data (as a reminder, this BLS data set lags the jobs report by a month), was a rather tame change with the number of job openings dropping by a modest 62K, the smallest monthly change since Dec 2020, to 8.790 million down from an upward revised 8.852 million (previously 8.733 million). This means that after the revision, the November number was still the lowest since April 2021, even though it was lower than the original October print (which was revised higher).

According to the BLS, in November job openings decreased in transportation, warehousing, and utilities (-128,000) and in federal government (-58,000). Job openings increased in wholesale trade (+63,000). Also, worth noting that a lot of the major job opening drops that were originally reported last month for October in fields like social assistance (-236,000), finance and insurance (-168,000), and real estate and rental and leasing (-49,000), have been revised higher.

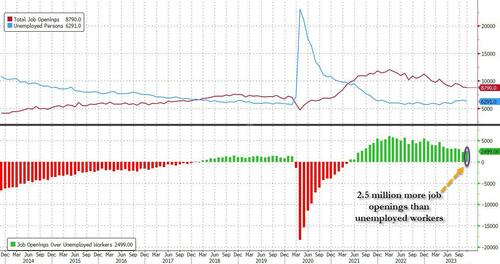

The continued modest drop in the number of job openings meant that in November, the number of job openings was 2.499 million more than the number of unemployed workers, up modestly from last month's 2.346 million which was the lowest since July 2021. This is due to the large drop in unemployed workers in November (6.291 million) from October (6.506 million).

Said otherwise, in November the number of job openings to unemployed dropped to just 1.34, the lowest level since August 2021 and almost back to pre-covid levels of 1.3... and a far cry from the record 2.0 hit in early 2022.

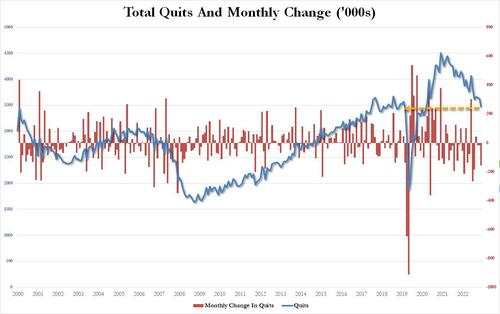

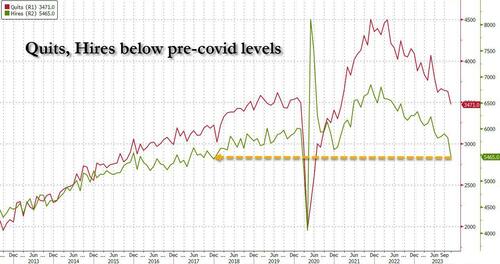

But what was more interesting than the number of job openings in November, was the number of quits: and as the number of job openings slumped to the lowest in more than two years, the number of people quitting their jobs - an indicator traditionally closely associated with labor market strength as it shows workers are confident they can find a better wage elsewhere - tumbled by 157K 3.471MM, which is at the 3.4 million level reported in Feb 2020, just before the covid shutdown. According to the report, the number of quits decreased in professional and business services (-77,000) and in educational services (-23,000). In other words, in at least one part of the labor market normality has been restored.

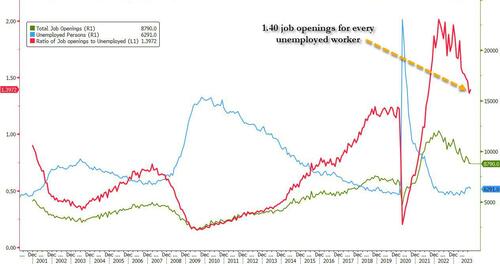

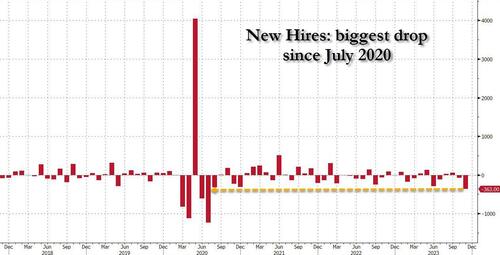

And just in case some still believe the "Bidenomics" strong jobs lie, the number of hires also crashed in November, sliding by 363K to 5.465 million, well below the pre-covid levels...

... as number of hires in professional and business services tumbled by a whopping -163,000. On a total monthly basis, the 363K plunge was the biggest since July 2020!

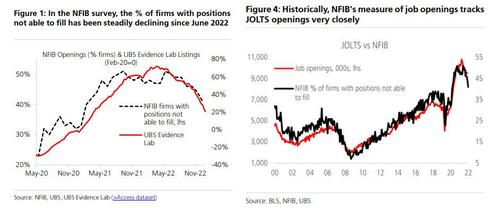

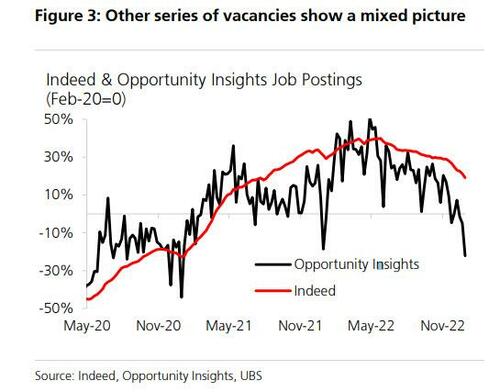

So what to make of this ugly data which as not only UBS, but also the NFIB...

... Opportunity Insights...

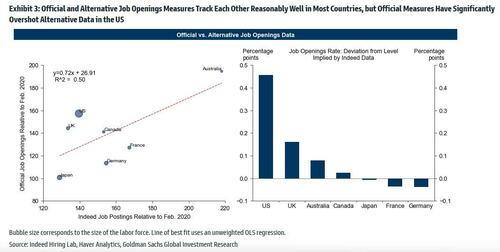

... and even Goldman ...

... have been warning is long overdue?

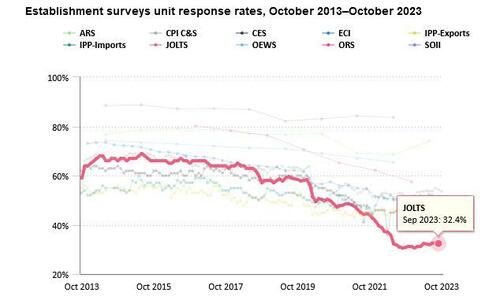

The answer is simple: while the drop was substantial, the real number of job openings remains still far lower since half of it - or some 70% to be specific - is guesswork. As the BLS itself admits, while the response rate to most of its various labor (and other) surveys has collapsed in recent years, nothing is as bad as the JOLTS report where the actual response rate has tumbled to a record low 32%

In other words, more than two thirds, or 70% of the final number of job openings, is estimated!

And at a time when it is critical for Biden to still maintain the illusion that at least the labor market remains strong when everything else in Biden's economy is crashing and burning, we'll let readers decide if the admin's Labor Department is plugging the estimate gap with numbers that are stronger or weaker.

As for the Fed, now that the labor market has officially cracked - because a sub 9mm print means that the rate hikes are really taking their toll on the economy - it is no surprise that stonks, which had traded near session lows before the report, are suddenly surging again as we are now officially back into "bad news is great news" for the market mode, since the end of Biden's fiscal stimmy means that only the Fed is available to kickstart the economy when it officially slides into a recession next.