Job Openings And Hires Slide As Workers Quitting Their Job Plunge To Pre-Covid Levels

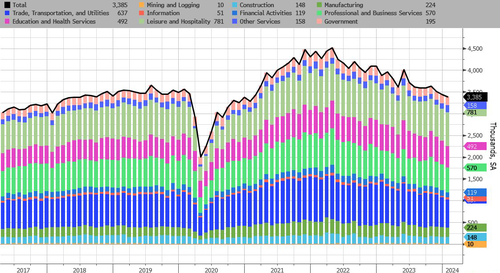

After declines in US job openings accelerated in the last few months of 2023, prompting economists to pat themselves on the back for predicting a soft landing and validating their expectations for Fed rate cuts, only to see the trend reverse dramatically last month when job openings unexpectedly surged back over 9 million, moments ago the BLS came out with the latest, January data (which as a reminder always lags the BLS by a month) and which showed another mixed report which revealed that in January job openings dipped modestly from a downward revised December print, but came right on top of expectations, even as both hiring and quits continued their recent slide.

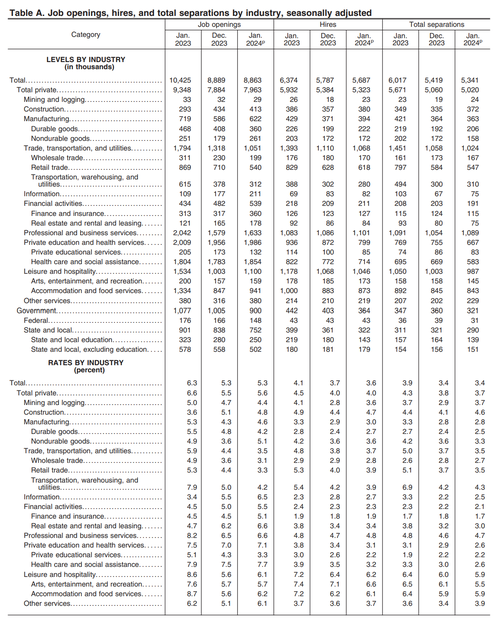

According to the Biden's Labor Department, in January the number of job openings dropped by just 42K in January to 8.863MM from 8.889MM. And speaking of the December print, last month we said that "we are certain will be revised lower next month as has been the case with everything under the Biden admin", and sure enough the number was indeed revised lower from 9026K to 8889K.

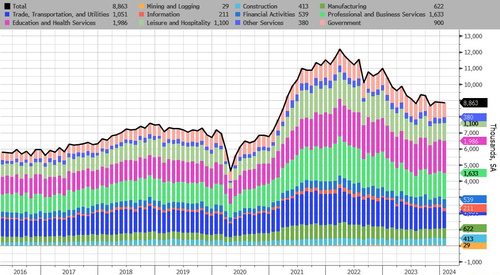

According to the DOL, in January, job openings increased in nondurable goods manufacturing (+82,000) but decreased in private educational services (-41,000). Government job openings also dropped by 105K to 900K.

And speaking of revisions, just like in the payrolls report, here too the BLS appears to be tasked with making a great, if erroneous, first impression then quietly revising it lower, and sure enough, 6 of the past 8 months have seen job openings revised lower!

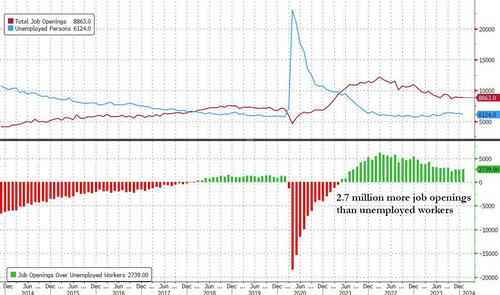

Accurate or not, the modest decline in the number of job openings meant that in January, the number of job openings was 2.739 million more than the number of unemployed workers (which the BLS reported was 6.124 million), up modestly from last month's 2.621 million.

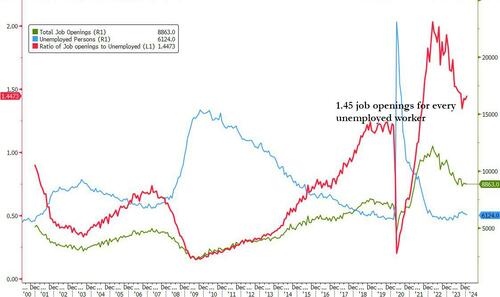

Said otherwise, in January the number of job openings to unemployed rose to 1.45, a sharp rebound from the October print of 1.35 which was the lowest level since August 2021 and almost back to pre-covid levels of 1.3... and then everything was revised.

But what was more interesting than the increase in the number of job openings in December - which we are certain will be revised lower again next month as has been the case with everything under the Biden admin - was the number of quits: here we find that the number of people quitting their jobs - an indicator traditionally closely associated with labor market strength as it shows workers are confident they can find a better wage elsewhere - tumbled again, sliding by 54K to 3.385MM, which is below the 3.4 million level reported in Feb 2020, just before the covid shutdown.

The number of quits increased in information (+23,000) but decreased in real estate and rental and leasing (-16,000). And unlike last month when the slide in quits was offset by increased hiring, in January there was no silver lining here with the number of workers hired slumped by 100K to 5.687MM. In short: ugly all around.

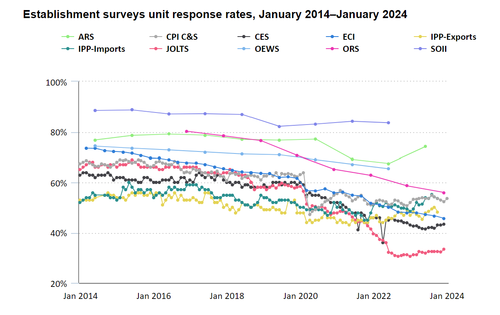

Finally, no matter what the "data" shows, let's not forget that it is all just estimated, and it is safe to say that the real number of job openings remains still far lower since half of it - or some 70% to be specific - is guesswork. As the BLS itself admits, while the response rate to most of its various labor (and other) surveys has collapsed in recent years, nothing is as bad as the JOLTS report where the actual response rate remains near a record low 33%

In other words, more than two thirds, or 70% of the final number of job openings, is estimated!

And at a time when it is critical for Biden to still maintain the illusion that at least the labor market remains strong when everything else in Biden's economy is crashing and burning, we'll let readers decide if the admin's Labor Department is plugging the estimate gap with numbers that are stronger or weaker (we already know that they always get revised lower next month).